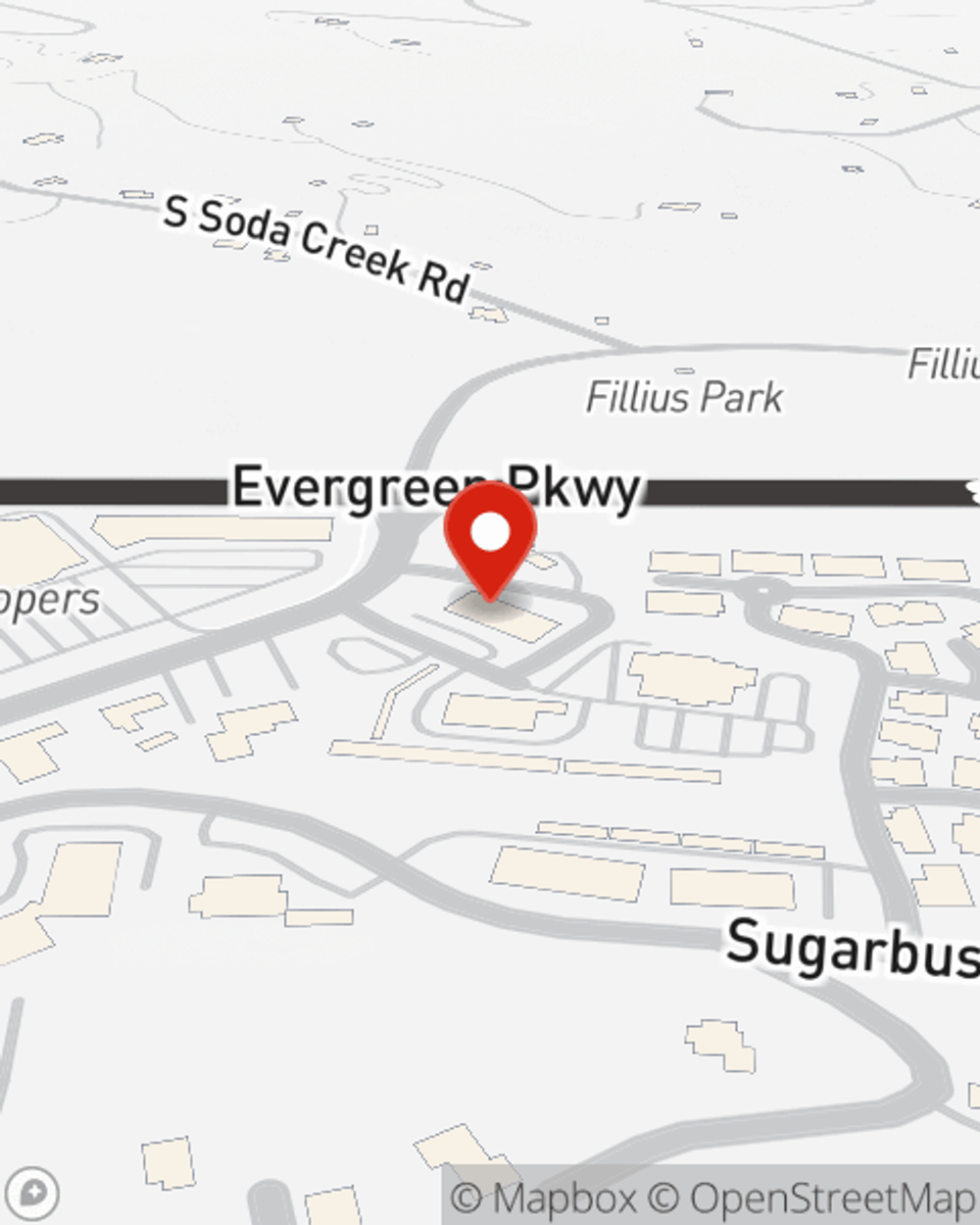

Business Insurance in and around Evergreen

Looking for coverage for your business? Look no further than State Farm agent Michelle Boley!

Almost 100 years of helping small businesses

- Evergreen

- Idaho Springs

- Blackhawk

- Golden

- Morrison

- summit county

- Georgetown

- Conifer

Help Protect Your Business With State Farm.

Preparation is key for when something unavoidable happens on your business's property like a customer stumbling and falling.

Looking for coverage for your business? Look no further than State Farm agent Michelle Boley!

Almost 100 years of helping small businesses

Strictly Business With State Farm

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or errors and omissions liability, that can be created to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Michelle Boley can also help you file your claim.

Don’t let worries about your business keep you up at night! Visit State Farm agent Michelle Boley today, and discover how you can save with State Farm small business insurance.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Michelle Boley

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.